醫療補助——適用於 65 歲以上、盲人或殘疾人(“非 MAGI”醫療補助)

There are TWO types of Medicaid. They are called MAGI and Non-MAGI. MAGI stands for the Modified Adjusted Gross Income category. Non-MAGI just means that someone doesn’t qualify for MAGI Medicaid.

https://www.lawny.org/node/21/

涵蓋 65 歲以上、盲人或殘疾人的 “非 MAGI”醫療補助的收入限額將於 2023 年 1 月增加到與 MAGI 相同的限額——適用於 65 歲以下沒有醫療保險的人。 這個限制是聯邦貧困線的 138%。 使用 2022 FPL,2023 年的新收入限制為: 單身 - 1563 美元/月(比 934 美元/月大幅增加) 情侶 - 2106 美元/月(比 1367 美元/月大幅增加)

Medicaid and Medicare Information

If you are a Medicaid consumer enrolled in the Surplus Income Program and will be having a non-legally responsible third party pay-in your surplus on your behalf, before they make the first payment they need to complete and submit this form.

If you have any questions about Medicare or Medicare Part D, or about choosing a Part D prescription drug plan or changing the one in which you were enrolled by Medicare, read more information here.

Access HRA

https://www.nyc.gov/site/hra/help/public-health-insurance.page

Medicaid Spend Down Attestation Form

Facilitated Enrollment Center

https://www1.nyc.gov/assets/ochia/downloads/pdf/facilitated-enrollers.pdf

http://www.wnylc.com/health/news/90/

Eligibility Expanded for Medicaid and Medicare Savings Program for Disabled/Age 65+/ Blind (DAB) in NYS Budget!

On April 8, 2022, the NYS Legislature and Governor reached an agreement on the NYS Budget, which included some important wins EXPANDING MEDICAID for New Yorkers age 65+ and those who have disabilities, and for undocumented immigrants age 65+. While advocates did not get everything, NYLAG thanks the Governor and Legislature for taking important steps to make health care more affordable for all and address racial disparities in health care.

- New York has followed California’s lead in expanding eligibility for Medicaid and the Medicare Savings Program. See Justice in Aging’s issue brief on expanding health care for older adults and people with disabilities.

- View this webinar held May 11, 2022, discussing this national trend sponsored by Justice in Aging, with participation by Valerie Bogart, NYLAG.

Here are the key changes coming in NYS:

Medicaid — for those Age 65+, Blind, or Disabled (“Non-MAGI” Medicaid)

1. INCOME LIMIT for “Non-MAGI” Medicaid, covering people Age 65+, Blind, or Disabled, will increase in Jan. 2023 to the same limit used for MAGI — for people under 65 who do not have Medicare. This limit is 138% of the Federal Poverty Line.

Using 2022 FPL, the new income limits in 2023 would be:

-

- Singles – $1563/mo (a big increase from $934/mo)

- Couples – $2106/mo (a big increase from $1367/mo)

- By using the same income limit for MAGI and Non-MAGI Medicaid, many Medicaid recipients who have MAGI Medicaid on NYS of Health will be able to keep Medicaid when they become enrolled in Medicare, whether based on turning age 65 or because they receive SS Disability benefits.

- Those with incomes above these limits will still be able to “spend down” excess income on medical bills, or enroll in Pooled Trusts to shelter income.

- TIMING – We hope that the timing will work out so that when the Public Health Emergency is expected to be declared over later in 2022, and all Medicaid recipients must go through a renewal, those who have MAGI Medicaid will be able to stay on Medicaid and not fall off the cliff – if their renewals are processed after Jan. 1, 2023, when the new income limits go into effect.

- Caveat – Some rules for counting “income” for MAGI are different than for non-MAGI. For example, for MAGI, Veterans’ benefits, Workmens’ Comp, and gifts or inheritances do not count as income, but they do count for non-MAGI.. So there will be some people eligible for MAGI Medicaid who will still have a spend-down when they switch to non-MAGI Medicaid. But – at least they will be able to “spend down” excess income or use pooled trusts, or use “spousal refusal” – none of which are possible in MAGI Medicaid.

2. ASSET LIMIT – Unfortunately, the limit on assets was NOT repealed, as a coalition of consumer advocates had proposed. (See more below). However, the asset limit will increase by about 50% in January, 2023. We estimate that the levels will be:

- Single increase from $16,800 to $28,134

- Couples increase from $24,600 to $37,908.

3. UNDOCUMENTED IMMIGRANTS – While Coverage4All did not pass, undocumented immigrants age 65+ will be eligible for Medicaid effective Jan. 1, 2023. They will be required to join a “mainstream” Medicaid managed care health plan.

NY SSL Sec. 366, subd. 1(g)(4)(a).

4. ESSENTIAL PLAN – For those under age 65, whose income is above the MAGI level, eligibility for the Essential Plan will increase from 200% to 250% FPL, and the benefit package will expand to include long term care services not previously covered. These are defined as “certain services and supports” for those “who have functional limitations and/or chronic illnesses that have the primary purpose of supporting the ability of the enrollee to live or work in the setting of their choice, which may include the individual’s home, a worksite, or a provider-owned or controlled residential setting.” it is unclear whether these long term care services are the same as those covered by Medicaid.

Medicare Savings Program (see this article)

Medicare Savings Program (see this article)

- QMB limits will be increased to the same level as the new Medicaid income limits – 138% FPL (from current level of 100% FPL)($ figures here). All people who have Medicaid under the new expanded limits, without a spend-down, will be eligible for QMB.

- SLIMB – this program will no longer exist in NYS, as everyone who had SLIMB will now get QMB, a better benefit because of balance billing protections.

- QI-1 – The income limit for this benefit will increase from 135% to 186% FPL. Like now, those who choose this benefit may not also have Medicaid, even with a spenddown. They must choose one or the other. Using 2022 figures, the income limits would be:

- Singles – $2107/mo

- Couples – $2838/mo

The three Medicare Savings Programs (MSP) are a crucial subsidy for Medicare beneficiaries. All 3 MSP programs:

- Pay for the monthly Part B premium, which in 2022 rose to $170.10 — ten percent of a Social Security check of $1,701/mo.

- Automatically qualify a Medicare beneficiary for FULL EXTRA HELP – the Medicare Part D prescription drug subsidy.

- Have NO ASSET limit.

When: Both the Medicaid and Medicare Savings Program increases will take effect Jan. 1, 2023, as long as CMS approves them, which is expected.

DOWNLOAD this Fact Sheet on the Changes from Medicare Rights Center here.

The fine print – read the actual bill A9006-C here. These changes are in Part AAA Sections 2-4, starting at page 259.

Background on Campaign to Expand Medicaid for Older New Yorkers and People with Disabilities

Background: In August 2021, a letter to Governor Hochul was sent by over 50 organizations that asked her to expand Medicaid eligibility for older adults and people with disabilities in the 2022-23 Executive Budget. These groups were left out of Medicaid expansion under the Affordable Care Act (ACA). Lead organizations on the letter included New York Legal Assistance Group, along with Medicaid Matters New York, the Medicare Rights Center, Community Service Society of New York, The Legal Aid Society, New York StateWide Senior Action Council

- NYLAG and the coalition sent a follow up letter to the Governor in December 14, 2021.

The Governor heard our message and in her State of the State message agreed that it’s time for New York to catch up to California and other states that have equalized access for seniors and people with disabilities. Her State of the State message stated, “This coverage expansion will eliminate the resource eligibility test and raise the income level to 138 percent of the federal poverty level for these populations for these populations. These changes will enable extremely low-income seniors and individuals with disabilities to easily maintain secondary Medicaid coverage when their Medicare eligibility begins — significantly reducing health disparities across the State, reducing unnecessary eligibility redeterminations, and increase administrative efficiencies.” Plan at page 35.

- Gov. Hochul’s landmark proposal to align rules for INCOME and ASSETS for Medicaid for people age 65 and disabilities with Medicaid for younger people, which was expanded under the Affordable Care Act — “so that low-income New Yorkers age 65 and up, as well as those with disabilities, are able to maintain Medicaid eligibility after they become eligible for Medicare. These changes would be effective January 1, 2023. New York’s current asset rules are biased against people of color, who statistics show are less likely to own homes and retirement funds, assets that are given special treatment as exempt from the current asset limit, while cash assets count. Medicaid requires a senior or person with a disability to “spend down” all income above $934/month (single) on medical care – which they cannot afford to do and still pay rent and buy food. Raising the limit to $1563/mo. – the same used for younger people — will ensure access to health care for thousands more low-income seniors and people with disabilities. See more here.

- Expand the income limits for the Medicare Savings Program or “MSP” – a lifesaving subsidy that saves low-income Medicare beneficiaries $170.10/mo. by paying their Part B premium, and also automatically qualifies them for Full Extra Help, the low income subsidy for Medicare Part D that makes prescription drugs affordable. NYLAG commends the NYS Assembly for including MSP expansion in its one-house Budget Bill A09007B.

- See all of NYLAG’s Health Priorities for NYS Budget SFY 22-23 here

- READ NYLAG’s Memo in Support of the MSP Expansion here.

Under the FINAL BUDGET, people like Sonya will no longer fall off the “Medicaid cliff” and lose Medicaid when they lose “MAGI” eligibility under the ACA because they get Medicare or turn 65.

- At age 64, Sonya has Medicaid with Social Security of $1481/mo. and $28,000 in life savings.

- But when she turns 65, under current rules, she will have to “spend down” $527month on medical expenses AND reduce her assets to $16,800 to qualify for Medicaid. She needs all of her income to pay bills, and her savings for emergencies.

- Had she owned her home or retirement funds, these would not count as an asset under current rules — but people of color are less likely than white people to own a home or have retirement funds. This is why we sought to repeal asset limits. While the final budget does not repeal asset limits, the increase in limits will still help many low income New Yorkers.

- Under the final budget, Sonya will be able to keep full Medicaid!!

Read NY Times article For Older Americans, Some Positive Health News, online Feb. 28, 2022

Read NYLAG’s statement applauding the Governor’s momentous position here.

Read NY Focus article Jan. 7, 2022 – Hochul Proposes Medicaid Expansion for Seniors and Disabled, Marking a Shift From Past Governors

The Final NYS Budget adopts at least in part all 3 points of our proposal:

- RAISES the Medicaid income eligibility level for people 65 and over and people with disabilities to 138% of the federal poverty level (FPL);

- INCREASES the Medicaid asset limit for people 65 and over and people with disabilities; and

- Raises the eligibility level for the Medicare Savings Program from 100% to 138% of the federal poverty level for QMB and to 186% FPL for QI-1.

通過對 MAGI 和非 MAGI Medicaid 使用相同的收入限制,許多在 NYS of Health 上擁有 MAGI Medicaid 的 Medicaid 接受者將能夠在加入

Medicare 時保留 Medicaid,無論是基於 65 歲還是因為他們接受 SS 殘疾好處。

那些收入超過這些限制的人仍然可以將多餘的收入“花掉”醫療費用,或者加入聯合信託來保護收入。

Link to Medicaid Spenddown

Link to Pooled Trust

Medicare Savings Programs (MSPs)

MSP 為低收入 Medicare 受益人支付每月的 Medicare B 部分保費,並使參保者有資格獲得 D 部分處方藥的“額外幫助”補貼。

There are no resource tests in New York's Medicare Savings Program.

有三個獨立的 MSP 計劃

合格的醫療保險受益人 (QMB) 計劃

合格的醫療保險受益人 (QMB) 計劃

指定的低收入醫療保險受益人 (SLMB) 計劃

合格的個人 (QI) 計劃

https://www.health.ny.gov/health_care/medicaid/program/update/savingsprogram/medicaresavingsprogram.htm

Forms

https://www.health.ny.gov/forms/doh-4328.pdf

Mailing Instruction

https://www.health.ny.gov/health_care/medicaid/ldss.htm

什麼是低收入補貼 (LIS)?支付處方藥費用

低收入補貼 (LIS) 幫助有 Medicare 的人支付處方藥費用,並降低 Medicare 處方藥承保的成本。

Enrolling in Extra Help

There are three basic ways to get into the LIS program:

1) by receiving Medicaid.

Medicaid recipients, including those who meet a spenddown, are “deemed” into LIS (automatically enrolled by SSA) and don’t have to file a separate application for Extra Help. See more below about how receiving Medicaid just for one month can qualify you for Full Extra Help for up to 18 months.

2) by enrolling in a Medicare Savings Program.

The Medicare Savings Program includes the Qualified Medicare Beneficiary (QMB) program, which covers beneficiaries up to 100% FPL; Specified Low-Income Medicare Beneficiary (SLIMB), for those between 100-120%; and the Qualified Individual (QI-1) program, for individuals between 120-135% FPL. There are no resource tests in New York’s Medicare Savings Program.) The New York State Department of Health posts the Medicare Savings Program income guidelines on their website. Just like Medicaid, Medicare Savings Program recipients are deemed into LIS and don’t need to apply through SSA. For more information see this article.

3) by applying for Extra Help through the Social Security Administration.

The Extra Help income limits are 150% FPL and there is an asset test. SSA lists the income and resource limits for Extra Help on their website, where you can also file an application online and get more information about the program. You can also find out information about Extra Help in many different languages.

See Medicare Rights Center chart on Extra Help Income and Asset Limits – updated annually

You can apply for Extra Help and MSP at the same time through SSA; SSA will forward your Extra Help application data to the New York State Department of Health, who will use that data to assess your eligibility for MSP.

Individuals who apply for LIS through SSA and those who are deemed into LIS should receive written confirmation of their Extra Help status through SSA. Of course, individuals who apply for LIS through SSA and are found ineligible are also entitled to a written notice and have appeal rights.

Benefits of Extra Help

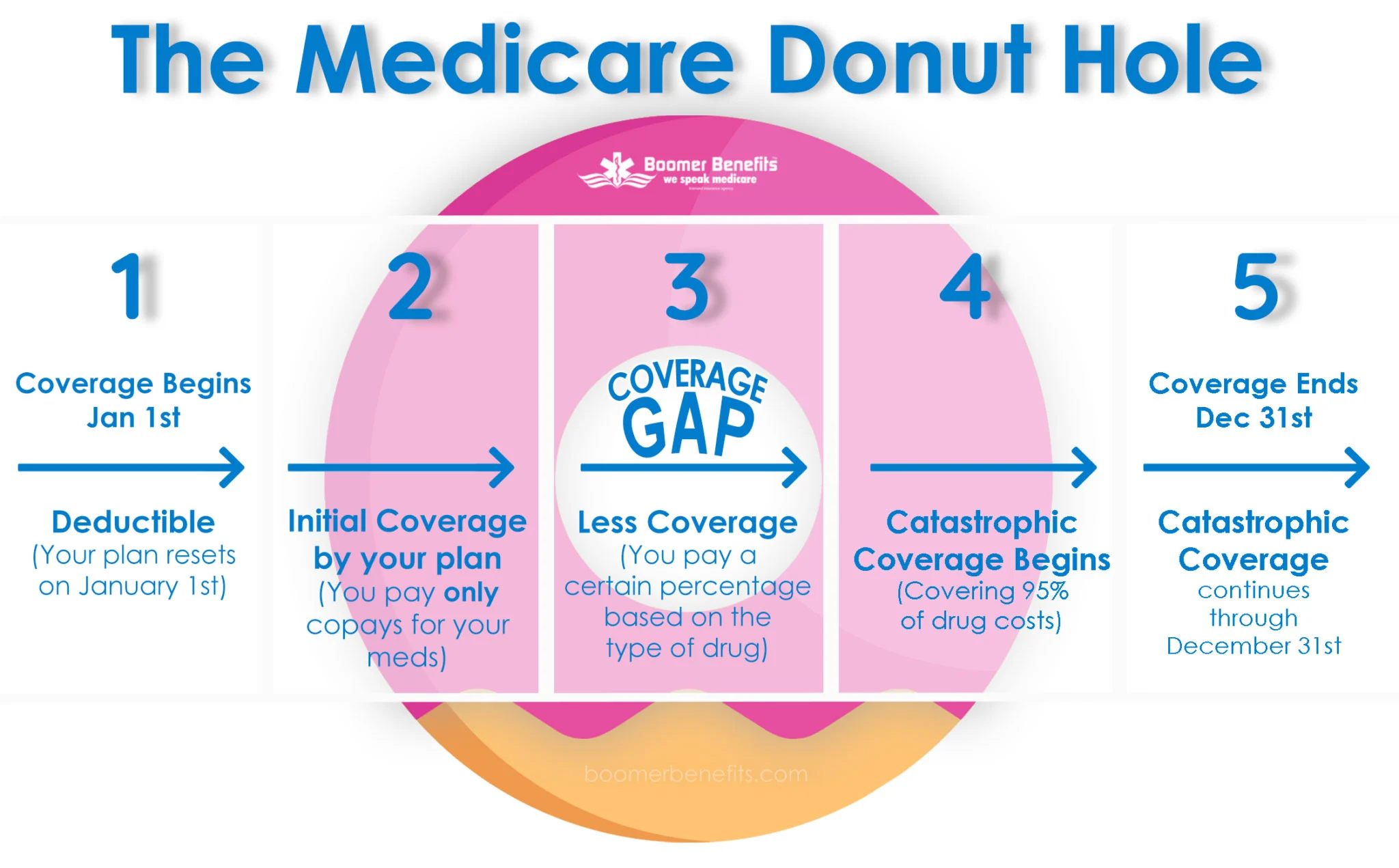

1) Assistance with Part D cost-sharing

The Extra Help program provides a subsidy which covers most (but not all) of beneficiary’s cost sharing obligations. Extra Help beneficiaries do not have to worry about hitting the “donut hole” – the LIS subsidy continues to cover them through the donut hole and into catastrophic coverage.

Full Extra Help:

LIS beneficiaries with incomes up to 135% FPL are generally eligible for “full” Extra Help — meaning they pay no Part D deductible, no charge for monthly premiums up to the benchmark amount, and fixed, relatively low co-pays (between $1.30 and $8.95 for 2020 depending on the person’s income level and the tier category of the drug; Medicaid beneficiaries in nursing homes, waiver programs, or managed long term care have $0 co-pays). Full Extra Help beneficiaries who hit the catastrophic coverage limit have $0 co-pays. See current co-pay levels here.

Partial Extra Help:

Beneficiaries between 135%-150% FPL receive “partial” Extra Help, which limits the Part D deductible to $89 (2020 figure – click here for updated chart); sets sliding scale fees for monthly premiums; and limits co-pays to 15%, until the beneficiary reaches the catastrophic coverage limit, at which point co-pays are limited to a $8.95 maximum (2020 or see current amount here) or 5% of the drug cost, whichever is greater.

2) Facilitated enrollment into a Part D plan

Extra Help recipients who aren’t already enrolled in a Part D plan and don’t want to choose one on their own will be automatically enrolled into a benchmark plan by CMS. This facilitated enrollment ensures that Extra Help recipients have Part D coverage. However, the downside to facilitated enrollment is that the plan may not be the best “fit” for the beneficiary, if it doesn’t cover all his/her drugs, assesses a higher tier level for covered drugs than other comparable plans, and/or requires the beneficiary to go through administrative hoops like prior authorization, quantity limits and/or step therapy. Fortunately, Extra Help recipients can always enroll in a new plan … see #3 below.

3) Continuous special enrollment period

Extra Help recipients have a continuous special enrollment period, meaning that they can switch plans at any time; they are not “locked into” the annual open enrollment period (October 15-December 7).

NOTE: This changed in 2019. Starting in 2019, those with Extra Help will no longer have a continuous enrollment period. Instead, Extra Help recipients will be eligible to enroll no more than once per quarter for each of the first three quarters of the year.

4) No late enrollment penalty

Non LIS beneficiaries generally face a premium penalty (higher monthly premium) if they delayed their enrollment into Part D, meaning that they didn’t enroll when they were initially eligible and didn’t have “creditable coverage.” Extra Help recipients do not have to worry about this problem – the late enrollment penalty provision does not apply to LIS beneficiaries.

為什麼有 LIS 計劃

退休金减少医药费上涨美国老人破产率25年升三倍

Extra Benefits,

- UHC Increase OTC (Dual Plan) to $200 & why you don’t want $255…

- HealthFirst & some other carriers can provide higher benefits for QMB (Depending on zip code)

- HealthFirst & some other carriers will allow OTC for none Medicaid (Downstate)

- Proposed Donut hole elimination by 2024

- IRA insulin cap & etc

- Unlimited Dental Scam

- Medicaid Asset Protection Trusts (MAPT)

- & many more …

What I can do for you…

What I can do for you…

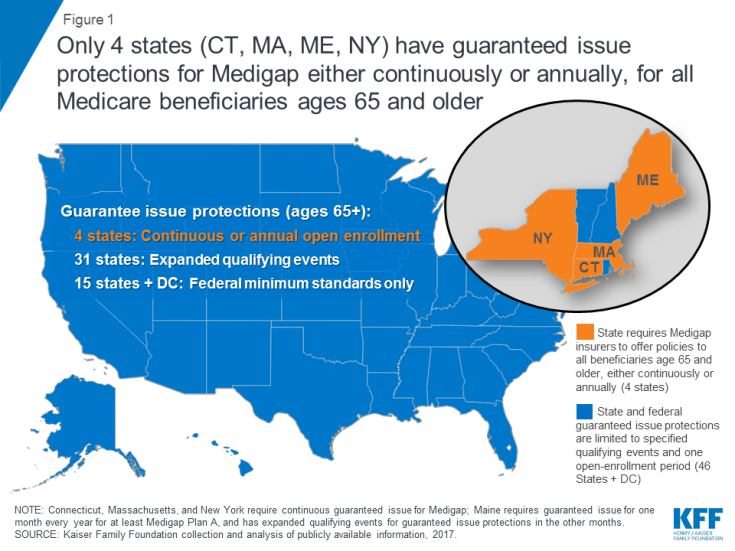

- Why you DON’T need to buy Medicare Supplement in NY & 3 other States

- https://www.kff.org/medicare/issue-brief/medigap-enrollment-and-consumer-protections-vary-across-states/#:~:text=Only%20four%20states%20(CT%2C%20MA,medical%20history%20(Figure%201).

- Q&A & resources

- https://www.youtube.com/c/RedBlueCard

- https://redbluecard.com/

- https://medicareful.com/safepolicies