Medicare 保險, 有 2 種主要方式

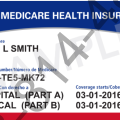

在 您首次登記參加 Medicare 時以及在每年的特定時間,您可以選擇如何獲得 Medicare 保險。有 2 種主要方式可獲得您的 Medicare 保險:• 「原有的 Medicare」 是個按服務付費的健保計劃,包含兩部分:A 部分(醫院保險)和 B 部分(醫療保險)。

在您支付免賠額後,Medicare 會支付其在 Medicare 承保金額中的份額,您應支付您的份額(共同保險和免賠額)。如果您想要 Medicare 藥物保險(D 部分),您可以參加單獨的Medicare 藥物計劃。• Medicare 優勢計劃(又稱為「C 部分」)是一種經由與 Medicare 簽約的私營公司所提供的 Medicare 健康計劃。這些計劃包括了 A 部分,B 部分,通常也包括 D 部分。這些計劃可能會提供一些原有的 Medicare 不承保的額外福利。

聯邦醫療保險優勢計劃,也被稱為Medicare Advantage (Part C)

Medicare Part C,聯邦醫療保險優勢計劃,也被稱為Medicare Advantage,是獲取Medicare保險的一種方式。

它是由Medicare批准的私人保險公司(例如HMO和PPO)所提供。 聯邦醫療保險優勢計劃必須涵蓋A部份和B部份(即Original Medicare原始聯邦醫療保險)提供的所有範圍。

Medicare Advantage計劃必須涵蓋所有原始Medicare(Part A和B)的服務。然而,它們可能適用不同的規則,成本和限制,這可能會影響你接受護理的方式和時間。

除了標準的Part A和B保險外,許多Medicare Advantage計劃提供原始Medicare未涵蓋的額外福利,例如牙科,聽力,視力和健康計劃。一些計劃也提供處方藥物保險,如果在原始Medicare中,則需要單獨的Part D計劃。

Medicare Advantage計劃的費用,包括保費,自付額和共付額,可以根據計劃和保險提供商的不同而變化。選擇最符合你的醫療需求和預算的計劃時,仔細比較不同的計劃非常重要。Medicare在其網站上有一個工具,Medicare計劃查找器,可以提供幫助。

在你可以加入Medicare Advantage計劃之前,你必須具有Medicare Part A和Part B,並且你必須住在計劃的服務區域。你可以在每年的特定時間,即入學期間加入計劃。

請注意,即使你加入了Medicare Advantage計劃,你仍然具有Medicare,你需要繼續支付你的Part B保費,以及計劃可能會收取的任何保費。