紐約市 65 歲以上長者的優惠地鐵卡資訊

紐約長者可以申請 MTA 半價優惠地鐵卡(Reduced-Fare MetroCard),享受與 Fair Fares 相同的 半價車資折扣。

如何申請 MTA 半價優惠地鐵卡(65 歲以上)

1. 申請資格:

- 年齡須滿 65 歲或以上

- 必須是 紐約市居民

- 無收入限制,所有符合年齡條件的長者都可申請

2. 可享優惠:

- 地鐵及指定 MTA 公車車資 50% 折扣

- 可使用 MetroCard 或 OMNY 感應支付系統

3. 申請方式:

- 網上申請:可透過 MTA 官網 填寫申請表

- 郵寄申請:可下載申請表,填寫後連同年齡證明(駕照、Medicare 卡或護照)郵寄申請

- 親自辦理:可前往 MTA 客戶服務中心(地址:3 Stone Street, Manhattan)或 MTA 指定的流動辦理點申請

4. OMNY 感應支付系統:

- 長者可將優惠折扣綁定至 OMNY 帳戶,透過 感應信用卡、手機或穿戴裝置支付半價票價

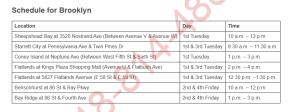

5. 申請老人車卡地址

-

Location Day Time Brooklyn Sheepshead Bay at 3520 Nostrand Ave (Between Avenue V & Avenue W) 1st Tuesday 10 a.m. – 12 p.m. Brooklyn Starrett City at Pennsylvania Ave & Twin Pines Dr 1st & 3rd Tuesday 9:30 a.m. – 11:30 a.m. Brooklyn Coney Island at Neptune Ave (Between West Fifth St & Sixth St) 1st Tuesday 1 p.m. – 3 p.m. Brooklyn Flatlands at Kings Plaza Shopping Mall (Avenue U & Flatbush Ave) 1st & 3rd Tuesday 2 p.m. – 4 p.m. Brooklyn Flatlands at 5827 Flatlands Avenue (E 58 St & E 59 St) 1st & 3rd Tuesday 12:30 p.m. –1:30 p.m. Brooklyn Bensonhurst at 86 St & Bay Pkwy 2nd & 4th Friday 10 a.m. – 12 p.m. Brooklyn Bay Ridge at 86 St & Fourth Ave 2nd & 4th Friday 1 p.m. – 3 p.m. The Bronx Riverdale at 235th Street and Johnson Avenue 1st Wednesday 9 a.m. – 11 a.m. The Bronx Woodlawn Heights at Woodlawn Heights Library 1st Wednesday 12 p.m. – 2 p.m. The Bronx Bartow Mall on Co-op City Blvd (Near GVS Eye Care Center) 1st & 3rd Thursday 10:30 a.m. – 3 p.m. The Bronx Metropolitan Avenue & Yankee Mall (in front of Macy’s) 2nd Wednesday 10 a.m. – 2 p.m. The Bronx Knolls Crescent Mall (11-21 Knolls Crescent) 2nd & 4th Friday 10 a.m. – 12 p.m. The Bronx Fordham Plaza (3 Av between 188 and 189 Sts at E Fordham Rd) 2nd & 4th Friday 8 a.m. – 2 p.m. The Bronx East Bronx at 3602 E. Tremont Ave (Between Scott Pl & Sullivan Pl) 2nd Friday 1 p.m. – 3 p.m. The Bronx Riverdale at Skyview Shopping Center (Riverdale Ave between 256 St & 259 St) 3rd Wednesday 10:30 a.m. – 12:30 p.m. The Bronx Kingsbridge at 231 St & Broadway 3rd Wednesday 1:30 p.m. – 3:30 p.m. Manhattan East Side at 57 St & First Ave 1st & 3rd Tuesday 1 p.m. – 3 p.m. Manhattan Lenox Hill at 68 St & First Ave (Near Memorial Sloan Kettering) 1st & 3rd Tuesday 10 a.m. – 12 p.m. Manhattan Lower East Side at Catherine St & Madison St 1st Wednesday 10 a.m. – 12 p.m. Manhattan Upper East Side at 79 St & York Ave (On York between 78 St & 79 St) 1st & 3rd Wednesday 10 a.m. – 12 p.m. Manhattan Lower East Side at Grand St & Lewis St 1st Wednesday 1 p.m. – 3 p.m. Manhattan Lenox Hill at 72 St & York Ave (In front of Manning Nursing Home) 1st & 3rd Wednesday 1 p.m. – 3 p.m. Manhattan Turtle Bay at 47 St & Second Ave 1st Thursday 1 p.m. – 3 p.m. Manhattan Carnegie Hill at 92nd Street Y 1st Thursday 10 a.m. – 12 p.m. Manhattan Kips Bay at 28 St & Second Ave 1st Thursday 10 a.m. – 12 p.m. Manhattan East Harlem at 106 St & Second Ave 1st Thursday 1 p.m. – 3 p.m. Manhattan Upper West Side at 96 St & Broadway 1st & 3rd Friday 10 a.m. – 12 p.m. Manhattan Upper West Side at 86 St & Broadway 1st & 3rd Friday 1 p.m. – 3 p.m. Queens Forest Hills at 71 Ave-Continental Ave & Queens Blvd 1st Friday 10 a.m. – 12 p.m. Queens Flushing at Main St & Roosevelt Ave (Facing Roosevelt Ave) 1st & 3rd Friday 8 a.m. – 3 p.m. Queens Rego Park at Mall (Marshalls) (Queens Blvd & 63 Rd) 1st Friday 1 p.m. – 3 p.m. Staten Island New Springville at Yukon Ave (Near Yukon Bus Depot) 2nd & 4th Tuesday 10 a.m. – 12 p.m. Staten Island Castleton Corners at Victory Blvd (Off Manor Rd) 2nd & 4th Tuesday 1 p.m. – 3 p.m.