就算有白卡,都有好多藥【唔包】 ? 因為PBM,它是什麼?

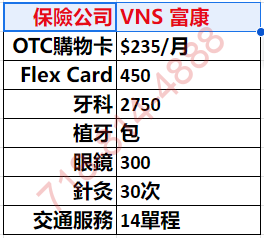

即便持有醫療保險卡,仍有諸多藥品不在給付範圍之內? 因為PBM? 什麼是 PBM?(Pharmacy Benefit Manager) 想像一下,PBM 是您 Medicare Part D 計劃背後的談判人員。他們利用數百萬受益人的集體購買力,與藥品製造商和藥房討價還價,希望能獲得更深層次的處方藥折扣。 以下2025是其他公司福利 富康 保險業的核心本質可以用一個字來概括:「錢」。 然而,不同的保險公司採取各異的營運策略。特別值得注意的是,有些保險公司採用了非傳統的商業模式。例如,某些藥房企業收購保險公司後,其營運模式就顯得格外特別。 這類企業似乎並不特別關注客戶的就醫頻率或藥物使用量,也不太在意保險理賠支出。相反地,多年來,他們一直專注於擴大藥品銷售,持續提升市場佔有率和企業價值。 這種商業策略反映出現代保險業務的多元化發展趨勢,也展現出跨產業整合帶來的特殊經營模式。 藥房福利管理與您的 Medicare … Read more